Table of Contents

For most Indian farmers, the journey ends the day the combine harvester leaves the field. They sell raw paddy at ₹2,200–₹2,600 per quintal and watch the rest of the value chain pocket the remaining ₹4,000–₹6,000 that premium rice finally commands in Mumbai, Dubai or London.

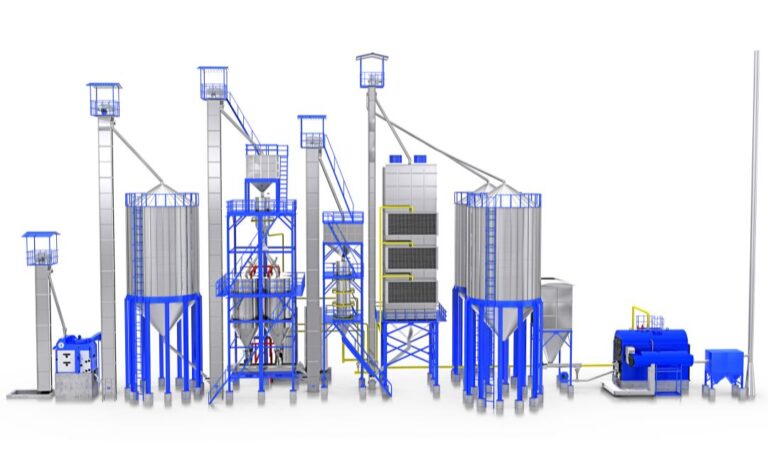

Yet in villages across Punjab, Chhattisgarh, Odisha and Andhra Pradesh, a quiet revolution is taking place. Farmers, FPOs and young rural entrepreneurs are discovering that owning even a small modern paddy processing unit can multiply farm income three to five times while creating year-round jobs in the village itself.

This is the real power of paddy processing in India: it is no longer just the miller’s business — it is becoming the farmer’s most powerful tool for prosperity.

The Missing Link in Indian Agriculture

India grows roughly 200–265 million tonnes of paddy every year and proudly calls itself the largest rice producer. Yet when it comes to farmer income, we still rank lower. The reason is simple: over 90 % of our farmers sell raw paddy immediately after harvest. The value addition — drying, parboiling, milling, polishing, colour sorting, packing and branding — happens hundreds of kilometres away in someone else’s mill.

A single example tells the story.

One quintal of raw Pusa-1121 paddy bought from a Punjab farmer at ₹2,400 is transformed step-by-step into:

- 68 kg head rice sold at ₹6,500–₹7,500 per quintal → ₹4,400–₹5,100

- 8 kg broken rice → ₹2,800 per quintal → ₹224

- 20 kg husk for fuel → ₹80

- 4–5 kg rice bran for oil extraction → ₹1,400–₹1,800

Total value created from the same quintal: ₹6,100–₹7,600

That ₹3,700–₹5,200 difference stays in the village hands only when processing happens locally.

Cutting Post-Harvest Losses – The Low-Hanging Fruit

Government estimates still quote 12–16 % post-harvest loss in paddy, but in rain-affected seasons the number easily crosses 25 %. Improper drying leaves grains cracked or mouldy. Storage in ordinary godowns invites insects and yellowing. By the time paddy reaches a distant mill, farmers have already lost ₹300–₹600 per quintal before a single machine is switched on.

Modern processing plants attack these losses at source:

- Mechanical dryers bring moisture down from 22–28 % to a safe 14 % in 18–24 hours without sun dependency

- Stainless-steel silos with aeration keep grain alive and healthy for 18–24 months

- Gentle handling systems (pneumatic conveyors, slow-speed elevators) prevent cracking

Farmers’ groups running 50–100 TPD plants routinely report losses dropping below 2 %, adding ₹400–₹500 per quintal straight to their pocket.

From Raw Paddy to Global Markets

The biggest leap comes when farmers stop selling raw grain and start selling finished products:

- Golden Sella 1121 sold to Saudi Arabia at ₹90–₹110 per kg

- Organic Swarna packed under their own village brand at ₹80–₹90 per kg in Delhi malls

- De-oiled rice bran cake exported to Bangladesh and Vietnam at ₹22–₹25 per kg

- Rice bran oil sold domestically at ₹140–₹160 per litre

A cooperative in Chhattisgarh’s Bemetara district could start with a 60-TPD plant in 2020. Today they would export 5,000 tonnes of Sella rice every year, run their own 10 TPD solvent extraction unit for bran oil, and pay farmers ₹700–₹900 extra per quintal over MSP. The same farmers who once migrated to brick kilns now earn regular wages in the mill plus dividends from profits.

Closing the Loop – Wastewater Treatment and Zero-Waste Rice Farming

Traditional rice mills are water-guzzling and polluting. The parboiling process alone can consume 1,500–2,000 litres of water per tonne and discharge hot, starch-rich effluent that kills fish in village ponds.

New-generation plants built by companies integrate:

- Closed-loop hot-water recycling systems that reduce fresh-water need to <300 litres per tonne

- Anaerobic + aerobic effluent treatment plants that produce biogas for boiler fuel

- Paddy husk used in gasifiers or boilers, replacing 100 % furnace oil or coal

- Treated water reused for irrigation

Paddy processing plant in Odisha now runs its entire boiler on biogas from its own wastewater and sells surplus power to neighbouring homes. Farmers get free treated water for the rabi crop and an extra ₹80 lakh per year from carbon credits.

How Accessible Has Paddy Processing Become for Indian Farmers?

Five years ago, only large traders could dream of owning a rice mill. Today the equation has changed completely:

- A modern 50–100 TPD turnkey plant costs ₹8–₹18 crore (including land and working capital)

- Government subsidies under AIF, PMFME and state agro-industries schemes: 35–50 %

- Bank loans at 7–9 % interest under priority sector

- Payback period: 3–4 years even after subsidy

More than 1,800 new farmer-owned mills have come up in the last four years. In Punjab alone, over 300 FPOs and cooperative societies now run their own processing units.

Conclusion

Paddy processing in India is undergoing its most important transformation since the Green Revolution. It is shifting from being an urban trader’s monopoly to becoming the farmer’s most powerful engine of prosperity.

When drying, parboiling, milling, oil extraction and wastewater recycling happen in the same village where the crop is grown, money multiplies, jobs stay local, losses vanish, and the environment heals.

The farmer who once sold raw paddy at the day after harvest is now becoming exporter, manufacturer, energy producer and brand owner — all from the same piece of land. That is not just value addition; it is the re-writing of rural India’s future, one grain at a time. Contact SKF elixer for paddy processing plant related queries.

Frequently Asked Questions (FAQs)

-

1. How much extra income can a farmer earn by installing a small processing unit?

Farmer groups running 50–100 TPD units typically add ₹600–₹1,200 per quintal over raw paddy price through better recovery, branding and by-product sales.

-

2. Is it possible to set up a modern rice mill with bank finance and subsidy?

Yes. Central and state schemes offer 35–50 % capital subsidy, and banks treat rice processing as priority-sector lending. Many FPOs repay loans entirely from milling profits within 4–5 years.

-

3. Can small mills produce export-quality rice?

Absolutely. Modern turnkey plants deliver the same head-rice recovery and polish as large mills. Several 50-TPD farmer-owned units regularly export 1121 Sella and Ponni Steam rice.

-

4. What happens to paddy husk and wastewater in these new plants?

Husk is used as boiler fuel or in gasifiers. Wastewater is treated to produce biogas, and treated water is reused for irrigation — achieving near-zero discharge.

-

5. How many rural jobs does one 100-TPD rice mill create?

Direct employment: 60–80 persons (operators, sorters, packers, security). Indirect: 150–200 (transport, packaging, bran oil unit, maintenance).

Good reads are meant to be shared