Table of Contents

Parboiled rice has carved a distinct place in kitchens around the world, where its firm texture and subtle nutty flavor stand out in dishes from West African jollof to Indian biryanis and Middle Eastern pilafs. This partially boiled grain, processed through soaking, steaming, and drying before milling, retains more of its natural vitamins and minerals compared to fully polished varieties.

India, with its vast paddy fields stretching across Punjab, Haryana, and Uttar Pradesh, remains at the heart of this story. Producing over 150 million metric tonnes of rice annually, the country accounts for nearly 40% of global exports, including a significant share of parboiled varieties like IR 64 and Sona Masoori. For businesses in the paddy processing sector, understanding these market forces opens pathways to sustainable growth.

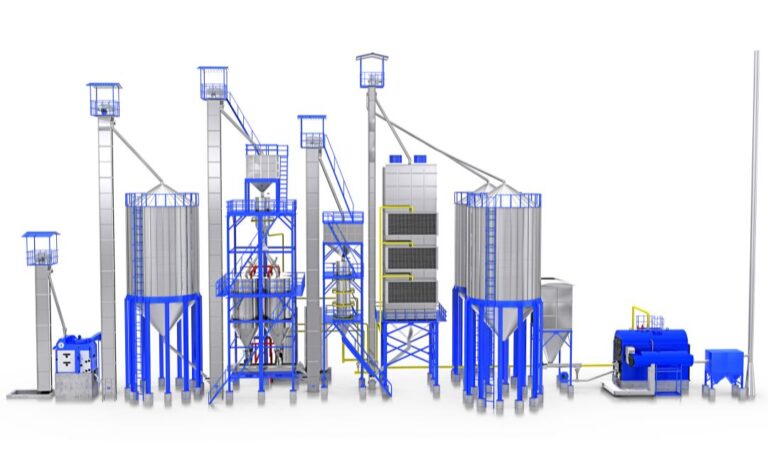

At SKF Elixer, we’ve spent nearly four decades upgrading parboiling plant technology, ensuring yields up to 10-15% higher through precise control of moisture and heat.

This blog delves into the evolving landscape of parboiled rice, exploring trends, trade flows, growth drivers, technological influences, and prospects for Indian players in the Parboiled Rice Export Market and beyond.

Current Global Market Trends for Parboiled Rice in 2025

The parboiled rice segment is experiencing measured yet resilient expansion in 2025, fueled by its role as a versatile, shelf-stable staple in both household and industrial applications.

In the Parboiled Rice Industry Trends, price stabilization plays a pivotal role. Following India’s removal of the 20% export duty on parboiled rice in October 2024, global prices dipped by 11%, settling at ₹40-45 per kilogram for bulk shipments. This affordability has boosted volumes, with exports projected to reach 9 million metric tonnes (MMT) worldwide in 2025, up from 8.2 MMT the previous year.

However, volatility from climate events—such as erratic monsoons affecting 10-15% of India’s kharif crop—underscores the need for resilient supply chains. Millers adopting hybrid drying systems report 5-7% fewer losses, highlighting how adaptive processing can buffer against these risks.

Top Importing and Exporting Countries of Parboiled Rice

The Parboiled Rice Export Market thrives on a network of key players, where exporters from Asia dominate outflows to import-dependent regions in Africa and the Middle East. India leads as the top exporter, shipping over 20 MMT of rice in 2025, with parboiled varieties accounting for 40-45% of its non-Basmati exports—roughly 8-9 MMT valued at ₹18,000-20,000 crore.

This dominance stems from abundant harvests and efficient milling hubs in Andhra Pradesh and Telangana, where facilities process 50-100 tonnes per hour. Thailand follows with 8-9 MMT, focusing on premium parboiled Jasmine for Southeast Asian and U.S. markets, while Vietnam exports 5.9 MMT, emphasizing long-grain types for Africa.

These flows underscore a bipolar trade: Asian exporters leverage scale for volume, while importers in Africa prioritize affordability and nutrition. For Indian firms, this means tailoring shipments—such as 25-kg PP bags for Nigerian wholesalers—to capture 50-60% market share in key destinations.

Factors Driving the Growth of Parboiled Rice Consumption

Several interconnected elements propel parboiled rice consumption forward in 2025, blending health imperatives with practical conveniences. Foremost is heightened nutritional awareness; parboiling drives B vitamins from the husk into the endosperm, boosting thiamine retention by 80% and reducing the glycemic index to 70-80 versus 89 for white rice, making it ideal for managing diabetes—a condition affecting 77 million Indians and 537 million globally.

Urbanization amplifies this, as city dwellers in Delhi or Dakar seek grains that cook in 15-20 minutes and yield fluffy results for one-pot meals. With global urban populations hitting 57% in 2025, convenience foods incorporating parboiled rice—think pre-seasoned pouches at ₹50-60—see 18% growth in e-commerce channels like BigBasket or Jumia.

Economic factors round out the drivers: rising middle-class incomes in Nigeria (up 6% to ₹4-5 lakh average household) enable premium spends on nutrient-rich staples, while government subsidies in India—₹2,000 crore for fortified rice distribution—enhance affordability at ₹35-40 per kilogram retail. Climate-resilient traits, like better storage in humid conditions (up to 18 months without infestation), also appeal in flood-prone regions, reducing post-harvest losses by 12%.

Collectively, these propel a market where parboiled rice not only feeds but fortifies global diets.

Impact of Technology and Quality Standards on Global Trade

Advancements in processing technology have revolutionized parboiled rice trade, elevating consistency and compliance to unlock premium markets. Automated systems, like PLC-controlled steam chambers, ensure uniform gelatinization at 70-80°C, minimizing breakage to under 5% and preserving whiteness scores above 30 on the Whiteness Index—critical for EU imports capped at 2% broken grains.

In India, laser-cutting machines from Swiss manufacturers slice components with 0.1 mm precision, enabling stainless-steel plants that run maintenance-free for over 10 years, as seen in SKF Elixer’s 7,000+ paddy parboiling plant installations worldwide.

Hot water automation boosts productivity by 20%, processing 50 tonnes daily while adhering to FSSAI limits of 0.1 ppm arsenic.

Quality standards, enforced by bodies like Codex Alimentarius (maximum 10% moisture, 1% foreign matter), act as trade gatekeepers. Compliance yields 10-15% price uplifts; for example, APEDA-certified Indian parboiled rice fetches ₹2-3 more per kilogram in Saudi tenders versus non-compliant lots.

Yet, challenges persist: smaller exporters face ₹5-10 lakh certification costs, though turnkey solutions from firms like SKF Elixer—covering design to commissioning—democratize access, cutting setup time to 45 days.

Future Outlook: Opportunities for Indian Parboiled Rice Exporters

Looking to 2026 and beyond, Indian exporters stand poised for expansion in a market projected to hit $23.4 billion by 2032, with parboiled rice capturing 25% share through value-added niches like organic and low-GI variants.

Policy tailwinds, including the 2025 IRRI strategy for sustainable systems, align with India’s ₹10,000 crore export incentive scheme, targeting 24 MMT shipments and ₹50,000 crore revenue. Emerging markets like Nigeria and Mexico offer 15-20% volume growth, where Indian IR 64 parboiled, at ₹38-42 per kilogram FOB Chennai, undercuts Thai competitors by 10%.

Tech integration, such as SKF Elixer’s in-house fabrication of heat exchangers and blowers, ensures 7000+ plants deliver 12-14% moisture uniformity, slashing logistics costs by ₹1-2 lakh per 100 tonnes.

Challenges like EU’s Green Deal residue caps demand R&D investment—₹50-100 lakh per mill—but yield 20% margins in compliant exports. For exporters, strategic alliances via platforms like BIRC 2025, connecting 3,500 millers to buyers, amplify reach.

In summary, the global demand for parboiled rice in 2025 weaves health, efficiency, and trade into a narrative of opportunity. For Indian stakeholders, embracing these insights—through robust processing like SKF Elixer’s turnkey rice parboiling plant solutions—ensures not just participation, but leadership in this vital market.

FAQs

-

1. What is the projected global production volume for parboiled rice in 2025?

Parboiled rice forms about 15-20% of total milled rice output, with global rice production expected to reach 525-530 MMT in 2025. This translates to roughly 78-106 MMT of parboiled varieties, driven by demand in Asia and Africa.

-

2. Which country is the largest exporter of parboiled rice, and what volume does it handle?

India leads with exports of 8-9 MMT of parboiled rice in 2025, valued at ₹18,000-20,000 crore, primarily to West Africa and the Middle East, thanks to its efficient processing infrastructure.

-

3. How does parboiling improve the nutritional value of rice?

The process steams paddy in the husk, transferring vitamins like B1 and minerals from the bran to the grain, resulting in 80% higher thiamine retention and a lower glycemic index of 70-80, beneficial for blood sugar management.

-

4. What technological advancements are key in modern parboiled rice processing?

PLC automation for gelatinization, laser-cut stainless-steel components, and optical sorting ensure 98% purity and under 5% breakage, with plants like those from SKF Elixer operating maintenance-free for over 10 years.

-

5. What are the main challenges for Indian parboiled rice exporters in 2025?

Climate variability and stringent quality standards like EU residue limits pose hurdles, but policy incentives and tech upgrades can mitigate losses, targeting 24 MMT total rice exports for the year.

Good reads are meant to be shared